Audio Version

Podcast Transcription

Video Version

In January’s Business of Cleaning podcast, listeners were able to hear Mark Miller, owner of Payroll Select Services LLC, speak with podcast host, Halie Morris, regarding the ins and outs and dos and don’ts of payroll processing.

Payroll Select offers payroll and tax assistance, HR solutions, time and attendance software, and benefits administration based out of Toledo, Ohio. While the majority of listeners may already have a basic idea of how payroll works from the outside, Mark provides insider tips and suggestions on how to run a tight financial ship within small to medium-sized businesses.

Why is Payroll such a Big Deal?

As we take a look at payroll, we can easily agree that no matter what type of industry one may find themselves in, it’s well-known that in order to keep employees happy, start with a fair wage and accurate payroll delivered on time.

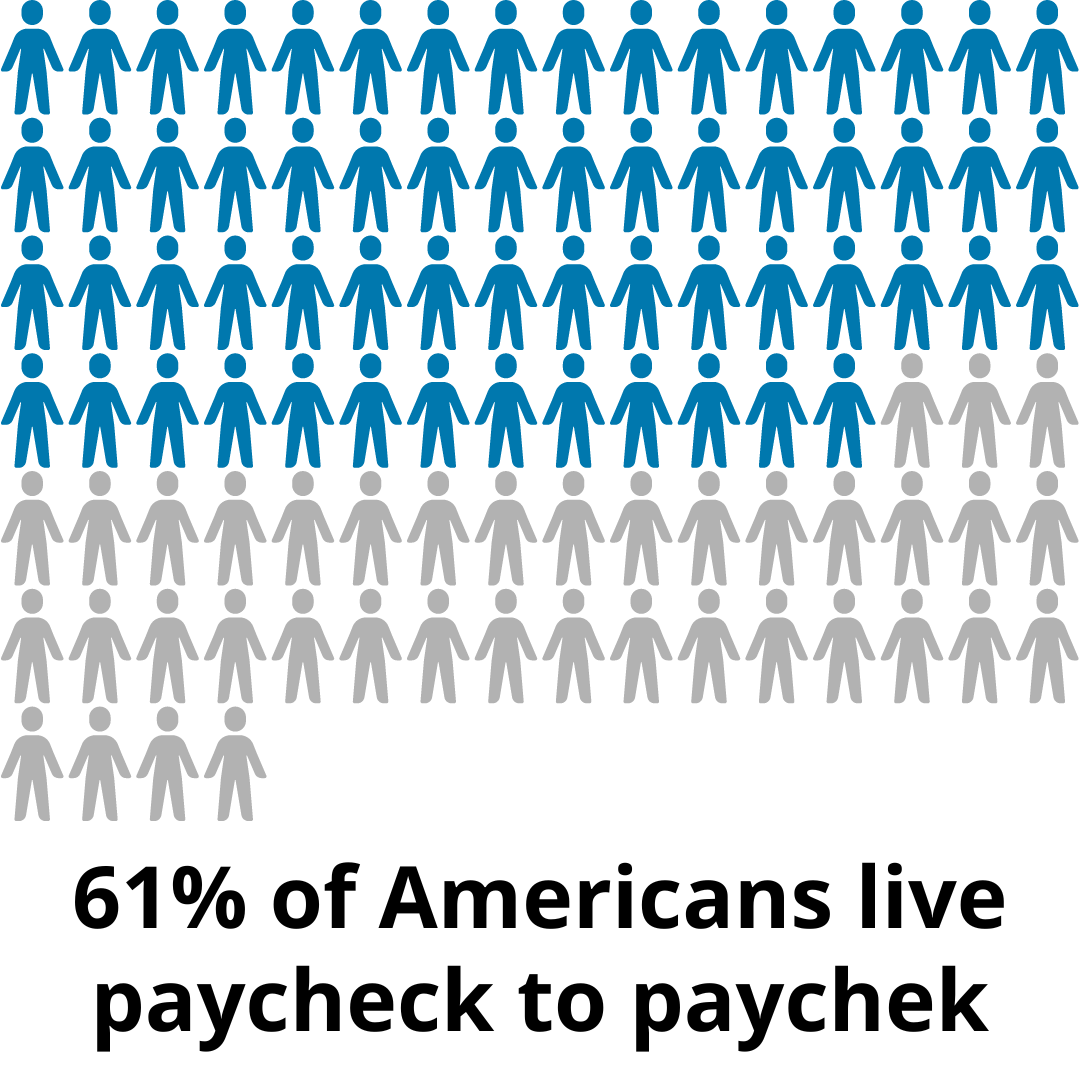

While employers can issue pay weekly, bi-weekly, semi-monthly, or monthly, by far the most popular pay frequency is bi-weekly. It’s important to keep this in mind as we look at the following statistic:

- Just last year, 61% of Americans were living paycheck to paycheck according to LendingClub.

As startling as this statistic is, it’s no wonder that many employees jump ship if they encounter errors with their pay. They can’t afford to do otherwise. In the cleaning industry, wrought with high turnover, organizations are always looking for new and better ways to keep employees happy.

Where to Start?

A good place to start is by taking a closer look at how payroll is processed and the number of errors that may or may not be occurring each pay period. If you see a trail of errors, that could very well be a contributing factor as to why workers are walking out the door.

According to recent surveys, “approximately one in four employees – 24 percent – will look for a new job after the first payroll mistake, while another 25 percent will seek new employment after the second issue.”

That means you could drive almost half of your workforce to job boards with only two payroll mistakes!

Now, in order to start eliminating payroll errors it’s a good idea to examine how efficient current processes are to determine if it would make more sense to start outsourcing payroll tasks to a third-party payroll provider instead of relying on an in-house team or financial department.

The Benefits of Outsourcing

As Mark points out during the show, sometimes it’s better to outsource payroll as it allows you to have a more “tree top” view of everything compared to being too in the weeds when looking at processes internally.

Often times, it’s the help of an outside perspective that enables businesses to shore up inefficiencies and button up holes that contribute to lost time or payroll mistakes. While outsourcing payroll can be more expensive, it’s all about weighing the pros and cons of what will work best for your company in the long run and what is the best fit culture-wise.

Financial Support & Understanding

Mark provides another angle to consider, thinking outside the box, as he presents a new idea that may aid in the quest to increase employee retention in how it relates to the financial realm.

Many Americans are experiencing financial strain, some caused by unfortunate circumstances, others by unforeseen medical expenses. More often than not, financial strains can stem from spending outside of one’s means and not practicing debt-free living or understanding the importance of savings.

Mark’s idea is one not too far from the Chinese philosopher Lao Tzu’s quote “Give a man a fish and you feed him for a day. Teach him how to fish and you feed him for a lifetime.” He suggests that business owners bring in a finance expert to talk with willing team members and provide advice and assistance in how to manage finances.

Understandably, this is more difficult and time-consuming to do as the decision to implement and act on the information lays in the hands of the employee. However, you never know the impact it could make.

As Mark states in the show, “If you’re helping to build a better person, you’ll have a person for life” meaning that employee is going to be one that sticks around for the long haul.

Technology in Payroll

Another aspect to consider is your onboarding process and ease of use for any software you have in place to assist with those processes.

This is an additional area that companies like Payroll Select can assist with. Depending on the system used, onboarding can be a breeze or a nightmare. Businesses need to ensure they have the time and the staff to help employees of all different technological backgrounds navigate through the onboarding processes, especially when it comes to processes such as supplying tax information and enrolling for benefits.

In Summary

Needless to say, there are many facets to payroll processing. I encourage readers to give the podcast a listen as Mark and Halie both take a deeper dive into payroll processing and all that it entails while providing listeners with best practices and tips on what to look out for when payroll rolls around.

About Our Guest(s):

Mark Miller

Owner - Payroll Select Services, LLC

Mark Miller, a native of Toledo, Ohio, founded Payroll Select Services LLC in 2007 after recognizing a need for companies to provide HR services without sacrificing business and customer relationships.

In fact, building relationships and community is what Mark and his company, Payroll Select, is all about. Besides excellent service and technology, Payroll Select offers payroll and tax services, HR services (HCM), time and attendance software and benefits administration. You can learn more about Mark and Payroll Select Services LLC here.